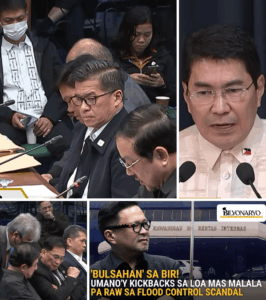

Senate Unveils Alleged LOA Scam in BIR, Prompting Calls for Stronger Oversight

A recent Senate hearing has shed light on allegations of widespread corruption within the Bureau of Internal Revenue (BIR), revealing that kickbacks linked to Letters of Authority (LOA) may have reached unprecedented levels. Officials allegedly diverted a significant portion of revenue from the government, raising concerns about accountability and transparency in tax collection.

During the Blue Ribbon hearings, it was disclosed that previous scandals, such as the flood control kickback case, were minor compared to the scale of alleged irregularities in the BIR. Reports indicate that while some government collections entered public coffers, a substantial percentage may have been misappropriated by individuals in positions of authority.

Senate Deputy Majority Leader JV Ehersito, observing the proceedings with what he referred to as “bantay buwaya” glasses, emphasized that such practices could not escape scrutiny. He highlighted the impact of these alleged kickbacks on both Filipino and foreign businesses, noting that even the European Business Chamber had voiced concerns regarding collection discrepancies.

The LOA system is designed to authorize the BIR to access company books and ensure proper tax compliance. However, allegations suggest that this mechanism has been exploited, with officials diverting up to 70% of the funds for personal gain, leaving only a fraction for government use. Such practices, if proven, undermine public trust and jeopardize the integrity of tax administration.

Following the revelations, the Finance Department and BIR immediately suspended all field audits and related operations. Officials emphasized their commitment to safeguarding taxpayers and pledged to review the processes to prevent future abuses. The swift response signals recognition of the gravity of the issue.

Senator Erwin Tulfo introduced Senate Resolution No. 180, calling on the Blue Ribbon Committee to conduct a thorough investigation into the LOA scandal and related corruption under previous BIR leadership. The resolution seeks accountability and aims to restore confidence in the agency’s operations.

Deputy Majority Leader Ehersito urged business owners to come forward and provide testimonies. He emphasized that public cooperation is crucial to uncovering the full extent of the alleged abuses and ensuring such practices are not repeated. Transparency and civic engagement remain essential in addressing systemic corruption.

Dexter Ganiben of Abante reported that the alleged misappropriated funds had far-reaching effects. Originally, the BIR targeted collections of Php6 billion, but only around Php2 billion reportedly entered government coffers. The remainder, allegedly diverted by unscrupulous officials, underscores the alleged scale of misconduct.

The revelations sparked discussions among lawmakers about the necessity of stringent oversight and stronger internal controls. Ensuring compliance and safeguarding public funds requires rigorous auditing, transparent reporting, and mechanisms to hold officials accountable for any misuse of authority.

Observers noted that the LOA allegations highlight the challenges of implementing policies without loopholes. Ambiguities in past regulations may have facilitated exploitation, underscoring the importance of clear, enforceable guidelines to prevent recurrence.

Public reaction has been significant, with media coverage amplifying scrutiny of the BIR’s operations. Citizens and business stakeholders alike are seeking clarity on accountability measures and potential reforms to prevent similar incidents in the future.

Officials stressed that investigations are ongoing and that corrective actions will be implemented where necessary. By suspending audits and reviewing internal processes, the BIR aims to restore integrity and reinforce taxpayer confidence.

The alleged LOA abuses have also prompted discussions on international implications, as foreign business entities have been affected by questionable tax practices. Ensuring equitable treatment and adherence to established rules remains a priority for regulators.

In addition, lawmakers highlighted the need for continuous monitoring and evaluation of BIR operations. Transparency, coupled with independent oversight, is crucial to prevent recurrence of similar scams and to protect government revenue.

The LOA scandal, if substantiated, exemplifies how regulatory tools intended for compliance can be misused when oversight is weak. It serves as a cautionary tale for public administration, highlighting the need for vigilance, accountability, and ethical stewardship of authority.

As the investigation unfolds, the Senate has committed to holding all responsible parties accountable. The hearings represent an effort to uphold the rule of law, ensure fair taxation, and reinforce the principle that no official is above scrutiny.

Ultimately, the revelations underscore the importance of systemic reform in revenue collection agencies. By addressing structural vulnerabilities and enforcing transparent procedures, government institutions can better protect public resources and maintain public trust.

News

Minsan, isang batang nakakita ng mali sa mundo ang nagkaroon ng kapangyarihang magligtas bago pa man malaman ng iba kung ano ang nangyayari.

“Minsan, isang batang nakakita ng mali sa mundo ang nagkaroon ng kapangyarihang magligtas bago pa man malaman ng iba kung…

Handa na ba ang inyong mga puso para sa isang kwentong magpapakita na hindi lahat ng kumikinang ay ginto

“Handa na ba ang inyong mga puso para sa isang kwentong magpapakita na hindi lahat ng kumikinang ay ginto?” May…

Minsan, isang simpleng tanong ang maaaring baguhin ang takbo ng isang araw… at buksan ang pintuan ng nakalimutang kasaysayan

“Minsan, isang simpleng tanong ang maaaring baguhin ang takbo ng isang araw… at buksan ang pintuan ng nakalimutang kasaysayan.” Lumakad…

Ilang buwan na lang bago ang kasal. Pero tuwing mag-isa si Kenneth sa kwarto, hindi niya mapigilang tingnan ang kalendaryo, parang may mali

Ilang buwan na lang bago ang kasal. Pero tuwing mag-isa si Kenneth sa kwarto, hindi niya mapigilang tingnan ang kalendaryo,…

Sa gitna ng kaguluhan, may tawag na hindi mo kayang balewalain

“Sa gitna ng kaguluhan, may tawag na hindi mo kayang balewalain.” Isang maliwanag na umaga ng Oktubre sa San Francisco…

Paano mo haharapin ang bigat ng pagkawala… kung bigla mong mararamdaman na may milagro pa pala?

“Paano mo haharapin ang bigat ng pagkawala… kung bigla mong mararamdaman na may milagro pa pala?” Sa malawak at tahimik…

End of content

No more pages to load