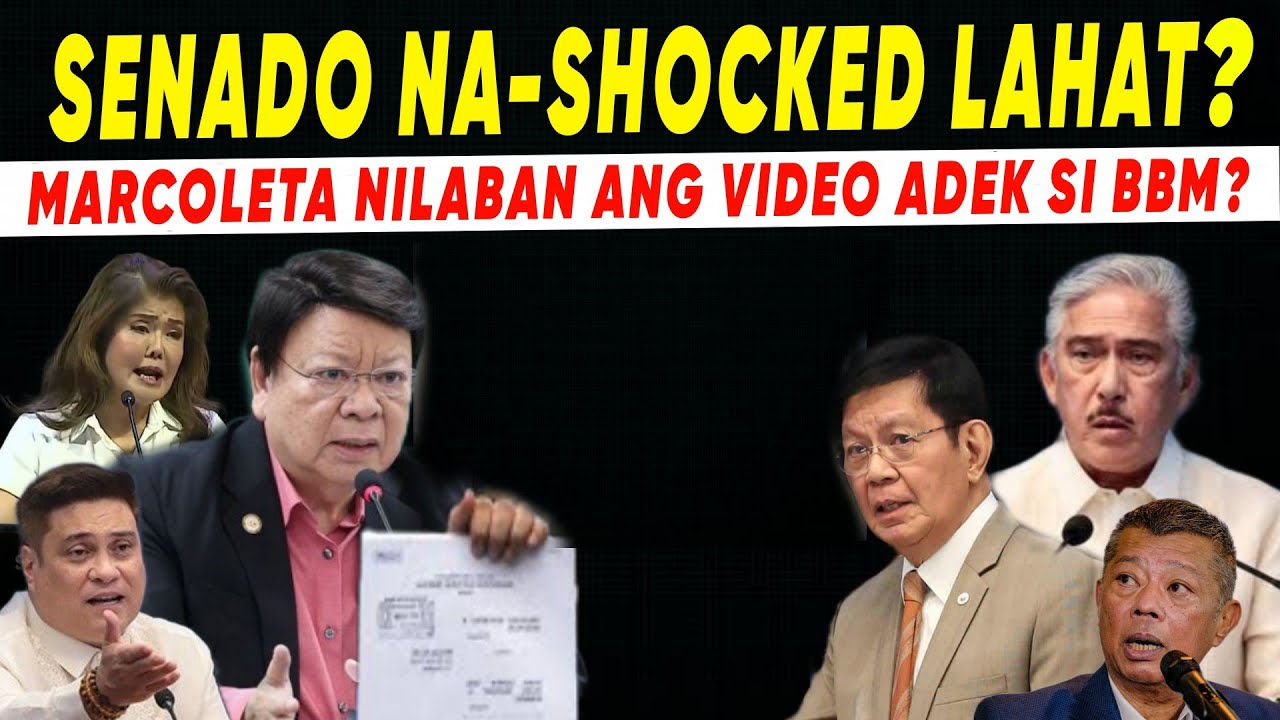

A political storm of unimaginable scale is currently raging through the government, ignited by a shocking declaration from within the presidential family itself. The President’s own sibling, Senator Imee Marcos, allegedly made a profound and unsettling public statement at a massive gathering, seemingly aiming at her brother, President Bongbong Marcos Jr., regarding sensitive and unsubstantiated personal issues. This unprecedented revelation, hinting at deep-seated personal struggles that could compromise the highest office, has sent seismic waves across the nation’s political landscape, alarming government offices, the media, and the public alike. The very foundations of public trust and the country’s stability are now in question as key political figures grapple with the fallout from this devastating family disclosure.

The claims swiftly became the central focus of a high-stakes Senate budget hearing, where Senator Rodante Marcoleta forcefully brought up the matter, demanding accountability and an assessment of the damage to national confidence. Marcoleta’s pointed questions immediately set a tense tone, linking the integrity of the administration to the stability of the entire country. The gravity of the situation was amplified when the Senate discussion quickly pivoted from the personal allegations to a stunning financial scandal: the massive sale of the country’s gold reserves. It was revealed that the Philippines had offloaded a staggering 24.95 tons of gold, becoming the world’s largest seller of the precious commodity at the time.

Senator Marcoleta expressed grave concern that this substantial sale had been conducted prematurely, significantly lowering the country’s gold holdings. He suggested that the timing was deeply flawed, arguing that by waiting until the price of gold reached its current high levels, the nation could have realized a profit potentially double the original amount—a difference of millions of dollars that could have bolstered the national treasury. While representatives from the Bangko Sentral ng Pilipinas (BSP) defended the action as a strategic move in “portfolio management” to shift assets into high-yield, low-risk classes, the senator’s line of questioning highlighted a critical lack of foresight and a potentially colossal opportunity cost for the struggling economy.

The financial anxieties only deepened as the Senate reviewed the alarming depreciation of the national currency, the Peso, which had recently weakened against the U.S. dollar. Economic managers conceded that the core reason for the Peso’s instability was a palpable decline in public and investor confidence, directly tied to political controversies. They pointed to pervasive corruption issues, specifically citing a major scandal involving questionable flood control projects, as the main driver of the “wait and see” attitude adopted by both international and domestic investors. This widespread lack of faith has led to a noticeable slowdown in foreign direct investments and local expansion, further crippling the nation’s economic recovery trajectory.

The consensus among officials and observers is that rebuilding trust is paramount and urgent. The government is now under immense pressure to demonstrate serious, actionable steps toward justice and accountability. The commitment to filing legal cases against those involved in corruption scandals, particularly the high-profile flood control irregularities, is seen as a necessary but challenging first step in restoring the nation’s reputation. As the administration attempts to implement a “catch-up plan” to accelerate vital public spending and infrastructure projects, the shadow of both the explosive personal claim and the critical financial blunders hangs heavy, making the road to national recovery a steep and uncertain climb.

News

Janitress na Itinakwil ng Pamilya ng Boyfriend Noon, Ginulat ang Lahat Nang Magpakilala Bilang CEO sa Kanilang Family Reunion!

Hindi habang buhay ay nasa ilalim tayo. May mga pagkakataon na ang mga taong inaapakan at minamaliit noon ay sila…

ANG MEKANIKONG NAKABISIKLETA: PAANO PINAHIYA NG ISANG DALAGA ANG 10 ESPESYALISTA AT PINALUHOD ANG ISANG BILYONARYO SA PAGPAPAKUMBABA

Sa ilalim ng nakapapasong init ng araw sa Uberlandia, Brazil, isang eksena ang umagaw sa atensyon ng marami—isang tagpo na…

DAYUHANG NAGHANAP NG PAG-IBIG SA CEBU, SINAPIT ANG MALAGIM NA WAKAS SA KAMAY NG ONLINE SYNDICATE

Sa mundo ng teknolohiya, tila napakadali na lamang maghanap ng koneksyon. Isang click, isang chat, at maaari ka nang makatagpo…

RETIRED SECRET AGENT, Naging Tricycle Driver Para sa Pamilya, Niligtas ang Bilyunaryang CEO Mula sa Kapahamakan at Binago ang Takbo ng Korapsyon sa Kumpanya!

Sa gitna ng mausok, maingay, at masikip na eskinita ng Tondo, may isang anino na tahimik na namumuhay. Si Elias…

Magsasaka, Ginipit ng Milyonarya: “Bigyan Mo Ako ng Anak o Ipapahabol Kita sa Aso” – Ang Kwento ng Pagbangon ni Noelito

Sa isang liblib na baryo sa San Isidro, kung saan ang hamog ng umaga ay humahalik pa sa mga dahon…

Batang Taga-Bundok, Hinamak sa Bangko Dahil sa Lumang Damit—Natahimik ang Lahat Nang Makita ang ₱100 Milyon sa Kanyang Account!

Sa mata ng marami, ang tagumpay ay nasusukat sa kintab ng sapatos, ganda ng damit, at garbo ng pamumuhay. Madalas,…

End of content

No more pages to load